SHC Your Benefits & W2 Statement

Benefits and Taxes

Several employee benefits programs that Stanford Health Care offers to eligible team members are non-taxable, meaning the hospital can help you pay for services without it being considered income; other programs are tax-advantaged, meaning that you can pay for services with part of your paycheck before taxes are calculated. In both cases, you have the capacity to save money throughout the year.

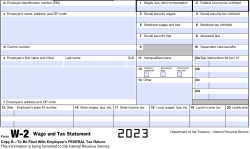

The Form W-2 reports what you earned and what taxes you paid during the tax year. Some benefits are reported on the forms even if they are non-taxable, and this causes confusion. It’s important to note that just because benefits are reported doesn’t mean you’ve paid taxes or will have to pay taxes on them. If you aren’t sure about your tax liability, consult with a tax professional or the IRS directly.

What this means for you

Below is an interactive Form W-2 to highlight where you might see benefits-related sums reported. Also included below is an alphabetical listing of benefits and directions to find them on your form.

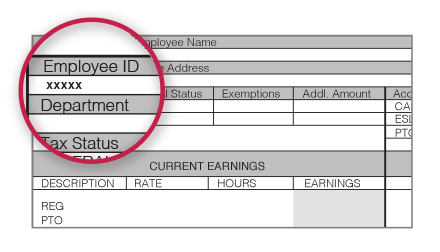

Your W-2 forms are mailed to you by the end of January each year and are available for a period of three (3) years on WorkDay.

Box A:

You should always double check your Social Security Number. If there is an error, AccessHR provides directions for how to correct it.

Box 1:

This reflects what you earned this year, which includes taxable benefits. This does not include:

-

wages earned from another employer last year

-

before-tax deductions for medical, dental or vision insurance, parking benefits or before-tax retirement contributions

-

wage replacement you were paid directly from The Hartford while on a family or disability leave; you will receive additional forms from The Hartford to submit with your tax filing that reflect additional wages you were paid on leave

Box 2:

This amount is determined based on your withholdings on your Form W-4. If it’s been a while since you looked at that form, you may want to log into AccessHR and review it.

Box 10:

Employers report dependent care benefits, which include your before-tax contributions to your dependent care FSA, as well as usage of Stanford Children’s Back-Up Care program available through Bright Horizons. You have not paid taxes on the first $5,000 of dependent care benefits; anything over $5,000 will be added to your Boxes 1, 3 and 5 (e.g. team members who participate in a dependent care reimbursement account who also participates in the Stanford Children’s Back-Up Care program in a given tax year). You may need to complete Form 2441, Child and Dependent Care Expenses, to compute any taxable and nontaxable amounts.

Box 12:

This is a collection of status codes and amounts to determine if something is taxable income.

The IRS website offers a complete list of codes. Here are some common codes that may relate to Stanford Children’s benefits:

-

DD — Cost of employer-sponsored health coverage; this is included for your information and is not taxable to you

-

W — Employer and employee contributions to your health savings account (HSA), which is not federally taxed but is taxable in California

-

E — Elective deferrals under a Section 403(b) salary reduction agreement

-

T — Adoption benefits (not included in Box 1)

Box 14:

CAVDI or CASDI refers to California state disability leave insurance, and the amount to which you paid into the insurance program this year. If you are unable to work due to a non-work related illness or injury, such as maternity leave, this income protection plan pays a benefit.

Alphabetical listing of benefits:

-

Adoption Assistance – Box 12, code T

-

Dependent Day Care FSA (DCFSA) – Box 10

-

Disability Pay – This will be sent to you separately from The Hartford

-

Out of Network Care (OONC) and back-up care – Box 10

-

Health insurance (employer contributions) – Box 12, code DD

-

Health Savings Account (HSA) – Employer and employee contributions – Box 12, code W

-

Retirement Savings Plan – Employee contributions – Box 12, code E

-

Stanford Children’s Tuition Reimbursement Program – Tuition reimbursement payments above the tax limit of $5,250 per tax year, may be tax exempt based on a participant’s response(s) to tax question(s) during the application process.

-

Student loan repayment funds are federally non-taxable if less than $5,250 per tax year; amounts over the limit would be considered taxable income and reflected in Box 1 and Box 16. California residents will be subject to state taxes regardless of $5,250 threshold.